Hong Kong Investment Corp (HKIC), the government's investment arm, on Tuesday appointed 10 asset managers spanning venture capital, private equity, private credit and hedge funds to oversee at least HK$3 billion (US$385 million) under its enhanced cash-for-residency scheme.

HKIC said in a statement that the new batch of managers for the investment portfolio under the New Capital Investment Entrant Scheme (New CIES) included Hong Kong-headquartered Value Partners, one of Asia's largest asset management firms, and Primavera Capital, whose founder and chairman Fred Hu Zuliu was a former partner and chairman of Goldman Sachs Greater China. Primavera's portfolio features Yum China, which operates fast-food chains in mainland China.

Other managers were Abax Global Capital, Beyond Ventures, CMC Capital, FirstLight Capital, Hidden Hill Capital, M Capital, Polymer Capital and Trustar Capital/Citic Capital with Vision Capital Investment Management, the statement said.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

"The managers provided concrete Hong Kong development plans in their proposals, illustrating their commitment to the long-term development of Hong Kong's economy, competitiveness and society," it said. "They also proposed various investment themes, including artificial intelligence-enabled applications, sustainable technologies, materials science and biotech."

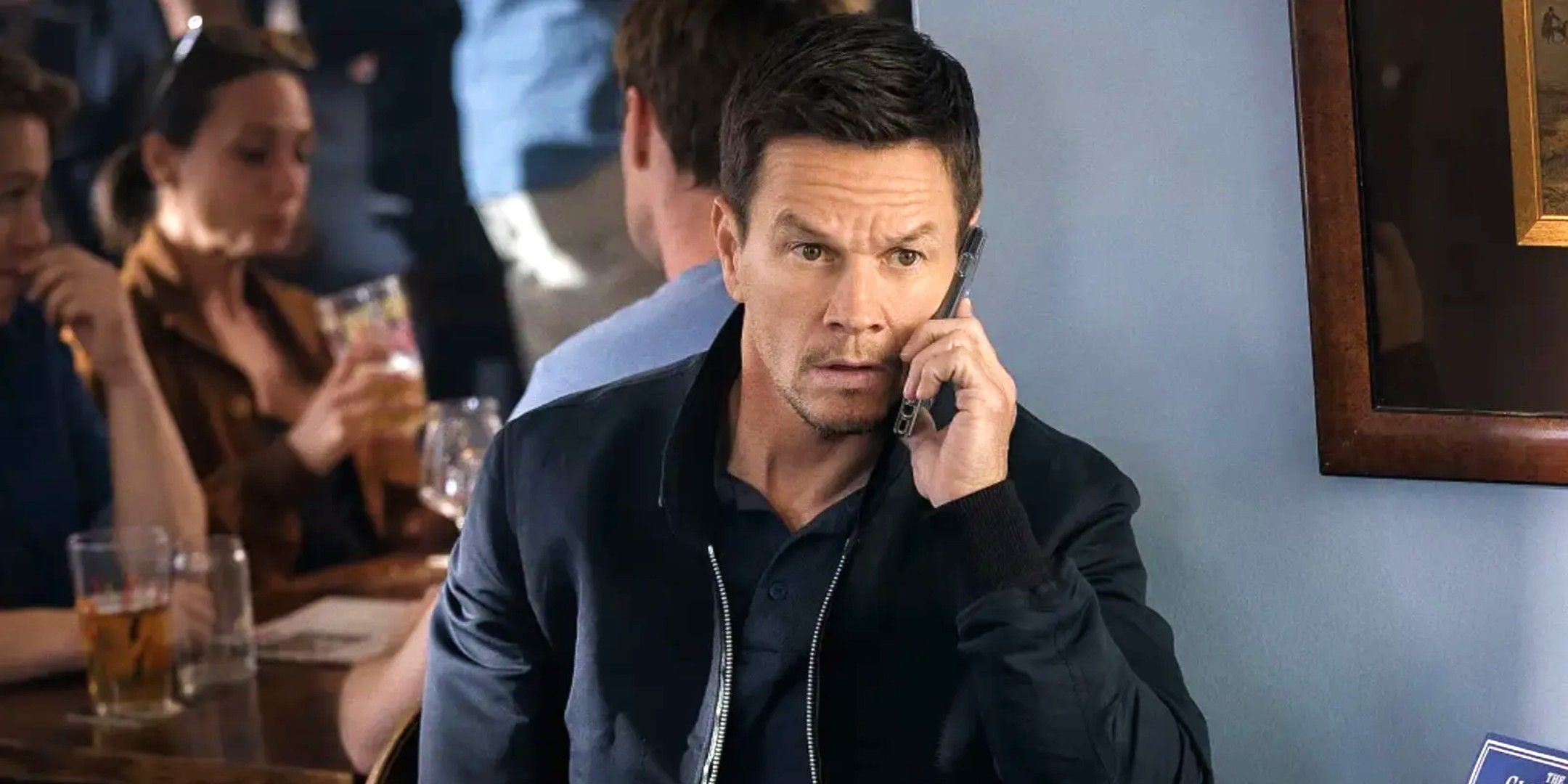

Fred Hu of Primavera Capital speaks at last month's Global Financial Leaders' Investment Summit in Hong Kong. Photo: Edmond So alt=Fred Hu of Primavera Capital speaks at last month's Global Financial Leaders' Investment Summit in Hong Kong. Photo: Edmond So>

Launched in March last year, the New CIES requires applicants to invest at least HK$30 million in "permissible investment" categories, including HK$3 million earmarked for the CIES investment portfolio (CIES IP).

CIES IP sought to support "the long-term development of Hong Kong's economy, competitiveness and society" and it specifically emphasised "nurturing home-grown or Hong Kong-based asset managers with commercial and strategic potential", HKIC said.

The asset managers would share the capital evenly under the scheme and begin work in the first quarter of 2026, HKIC added. It said it would closely monitor the operations of CIES IP and make announcements in due course.

繼續閱讀The asset managers were diversified in background, investment strategy and practical experience, reflecting market confidence in the scheme, the statement said.

The selection process was supervised by KPMG, with Clifford Chance providing legal advice, HKIC said.

Last year, HKIC named Betatron Venture Group, Inno Angel Fund, MindWorks Capital and Radiant Tech Ventures to manage a fund set up under the CIES. It also appointed BOCI-Prudential Trustee as the fund administrator.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2025 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.

條款 及 私隱政策 Privacy Dashboard More Info